Bitcoin traders turn to $93K yearly open as BTC price hits 6-week high

Published on Tuesday, April 22, 2025 by Cointelegraph | Found on Glideslope.ai

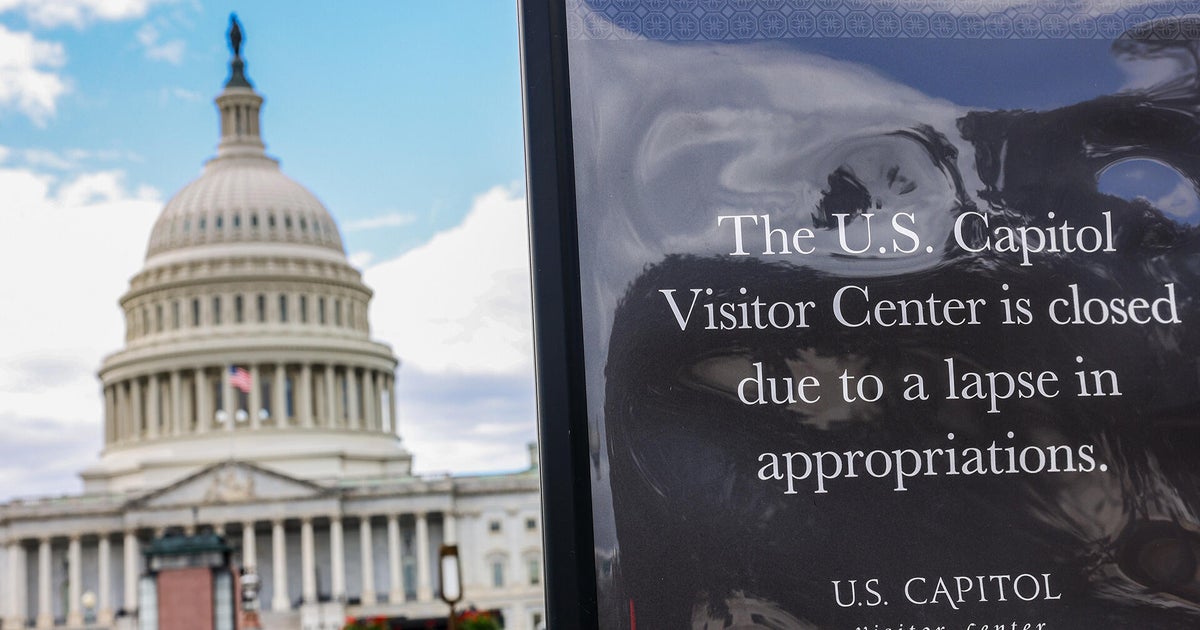

Bitcoin (BTC) hit six-week highs on April 22 as US trade war tensions emboldened crypto bulls.BTC/USD 1-hour chart with 200SMA. Source: Cointelegraph/TradingViewBitcoin lines up resistance flips around $90,000Data from Cointelegraph Markets Pro and TradingView showed BTC/USD above $91,000 after the Wall Street open — its highest since March 7.Bitcoin and gold benefited from increasing market nerves over how China, Japan and others would respond to US trade tariffs.XAU/USD set fresh all-time highs on the day, while BTC/USD faced a key bull market support trend line that has been acting as resistance since early March.BTC/USD 1-day chart with 200SMA. Source: Cointelegraph/TradingViewFor traders, the 200-day simple moving average (SMA) at $88,370 thus became the level to flip back to support on daily timeframes.“Closing in on the big $90K-$91K horizontal area which acted as the previous range low,” popular trader Daan Crypto Trades wrote in part of ongoing analysis on X. An accompanying chart showed the need to crack the area around $93,000 — Bitcoin’s yearly open — to confirm the moving average reclaim. BTC/USDT perpetual contract 1-day chart. Source: Daan Crypto Trades/XContinuing, Keith Alan, co-founder of trading resource Material Indicators, had similar views.“If history has taught us anything, it's important to watch for fake outs and confirmations,” he noted. “IMO, confirmation of the trend reversal will come when BTC reclaims the Yearly Open. That move will put price on a trajectory to unwind the key moving averages and deliver a series of Golden Crosses in the days and weeks ahead.”BTC/USD 1-day chart. Source: Keith Alan/XBTC price rebound skepticism remainsFellow trader Roman, meanwhile, was among those staying cautious on the validity of a short-term BTC price swing.Related: US dollar goes 'no-bid' — 5 things to know in Bitcoin this week“Price now retesting prior support as resistance for now. A breakout above 93k would be great for bulls, however, I’m unsure if we get it,” he told X followers about the weekly chart. “Wait for weekly close before you make assumptions or get excited. We’ve seen so many fakeouts before. 5 days left!”BTC/USD 1-week chart with 200SMA. Source: Cointelegraph/TradingViewAlso unsure that the move would last was popular analytics resource Ecoinometrics, which acknowledged that Bitcoin ultimately lost out when the Nasdaq 100 index was below its own 200-day SMA.“Bitcoin is climbing. The NASDAQ is sliding. That kind of divergence doesn’t usually last,” it summarized on the day. “Historically, when the NASDAQ’s 200-day moving average trend is down, Bitcoin runs into macro headwinds.”BTC/USD vs. Nasdaq 100 chart. Source: Ecoinometrics/XThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Pulse AI Analysis

Score: 12.57

Sentiment Score: 12.57 - Leaning optimistic.

This analysis was generated using Pulse AI, Glideslope's proprietary AI engine designed to interpret market sentiment and economic signals. Results are for informational purposes only and do not constitute financial advice.