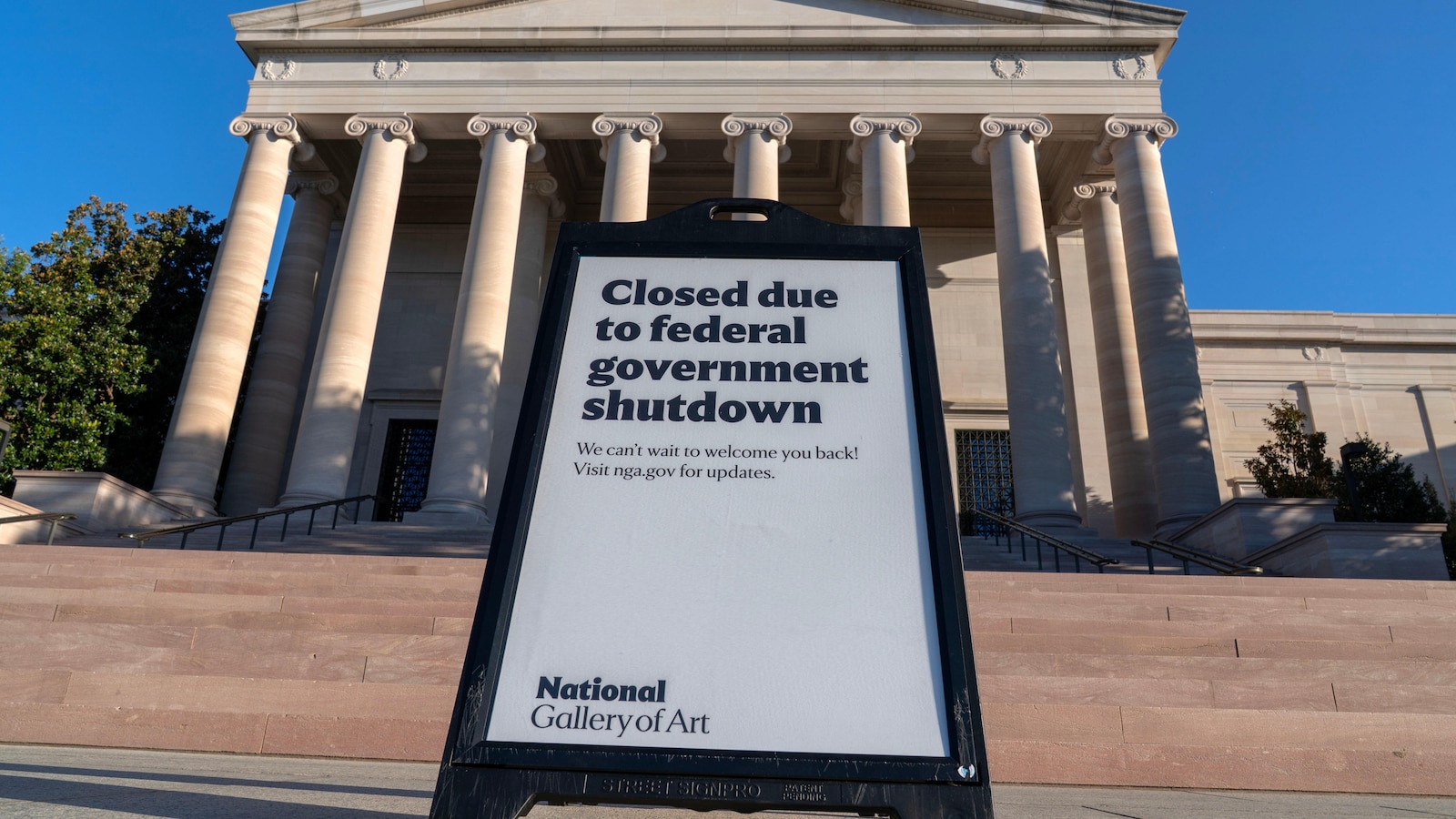

The government shutdown putting spotlight on the cracks in the US aviation system

Published on Wednesday, October 15, 2025 by ABC News | Found on Glideslope.ai

The U.S. government shutdown’s strain on the aviation system is starting to show

Pulse AI Analysis

**Market and Economic Implications:**

- **Increased Operational Costs:** Airlines may face higher costs due to delays and rerouting, impacting their bottom line.

- **Stock Volatility:** Aviation stocks could see increased volatility as investors respond to immediate operational challenges and longer-term concerns over infrastructure and staffing.

- **Consumer Confidence:** Frequent delays and security concerns might deter travelers, potentially reducing airline and airport revenues.

- **Investment Delays:** Critical technology upgrades and staffing initiatives are on hold, delaying improvements needed for safety and efficiency.

- **Sector-wide Repercussions:** The ripple effect of aviation disruptions can impact tourism, business travel, and related sectors like hospitality and retail.

This shutdown serves as a critical reminder of the need for resilient and well-funded aviation infrastructure to avoid significant disruptions and safety risks in the future.

Score: -100.00

Sentiment Score: -100.00 - Very bearish.

This analysis was generated using Pulse AI, Glideslope's proprietary AI engine designed to interpret market sentiment and economic signals. Results are for informational purposes only and do not constitute financial advice.