Canada plans wider deficits to jolt economy

Neutral

0.0

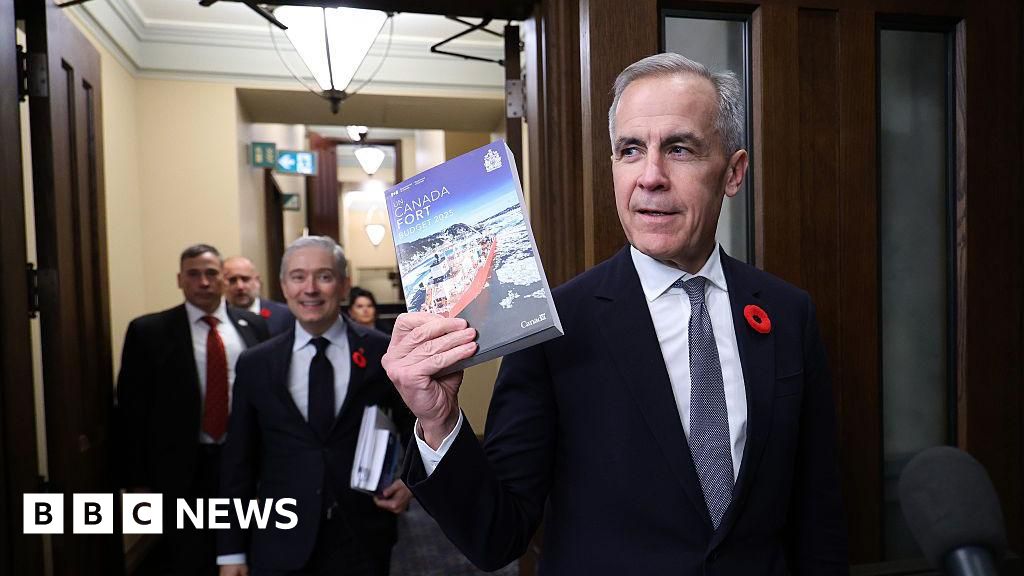

Prime Minister Mark Carney’s government said it would cut the size of the federal public-sector workforce by about 5%, or 16,000 jobs.

Pulse AI Analysis

Canada's government, led by Prime Minister Mark Carney, has announced a reduction in the federal public-sector workforce by approximately 5%, equivalent to 16,000 jobs.

This decision is a double-edged sword for the market. On one hand, reducing the public-sector workforce can help in trimming government spending, potentially decreasing the deficit over the long term. On the other hand, the immediate loss of jobs can impact consumer spending and confidence, which might slow down economic growth in the short term. This move, aimed at jolting the economy, also signals a shift towards potentially more conservative fiscal policies, which could influence investor sentiment. Investors in sectors dependent on government spending or those sensitive to economic cycles should watch closely.

- Reduction in public-sector jobs may initially slow economic growth due to decreased consumer spending.

- Potential long-term decrease in government spending could reduce deficits, impacting bonds and interest rates.

- Investors in sectors reliant on government contracts should reassess the potential impact on earnings.

This decision is a double-edged sword for the market. On one hand, reducing the public-sector workforce can help in trimming government spending, potentially decreasing the deficit over the long term. On the other hand, the immediate loss of jobs can impact consumer spending and confidence, which might slow down economic growth in the short term. This move, aimed at jolting the economy, also signals a shift towards potentially more conservative fiscal policies, which could influence investor sentiment. Investors in sectors dependent on government spending or those sensitive to economic cycles should watch closely.

- Reduction in public-sector jobs may initially slow economic growth due to decreased consumer spending.

- Potential long-term decrease in government spending could reduce deficits, impacting bonds and interest rates.

- Investors in sectors reliant on government contracts should reassess the potential impact on earnings.

This analysis was generated using Pulse AI, Glideslope's proprietary AI engine designed to interpret market sentiment and economic signals. Results are for informational purposes only and do not constitute financial advice.